Video Marketing for Your Business - A Beginner’s Guide

Turn viewers into customers with video marketing. A beginner's guide to creating high-impact videos for your business

Let us first understand what GST is besides being known as Goods & Service Tax.

GST is a tax that you pay when you buy things or pay for services. Before GST, many different taxes existed like VAT, service tax, etc. All those have been removed and replaced by one uniform taxation system known as GST.

The main idea of GST is to make tax payment simpler by combining many taxes into one single tax. That's why it's called the "Goods and Services Tax" - one tax for goods (things you buy) and services (work done for you).

When you buy something from a shop or pay someone to do some work for you, you have to pay a little extra money called GST. This GST money goes to the government.

GST is the same tax for the whole country. So whether you buy something in one state or another, you pay the same GST tax is again differentiated into two which we will go over below.

If you buy something within your state, you have to pay two taxes - one to the central government (Central GST/CGST) and one to your state government (State GST/SGST).

But if you buy something from another state, you only pay one tax called the Integrated GST (IGST).

The tax is charged every time something is sold, whether within the state or between states.

Now, one can wonder when would the tax be levied on a particular product. The answer is simple, during every step of the production process.

Imagine you want to buy a toy car. But before it reaches you, the toy car goes through many hands.

So, at every step from the factory to the shop, GST is paid whenever the toy car changes hands or there is some added value like production, warehousing, etc. It ensures that the government collects tax at every stage, instead of just the final sale to you.

Now, that we have a basic understanding of what GST is, let’s dive into GST as an ecommerce seller or ecommerce merchant.

Let me explain this in simple terms using an example:

Imagine there is an online shopping website like Amazon or Flipkart. This website is called an e-commerce portal or operator.

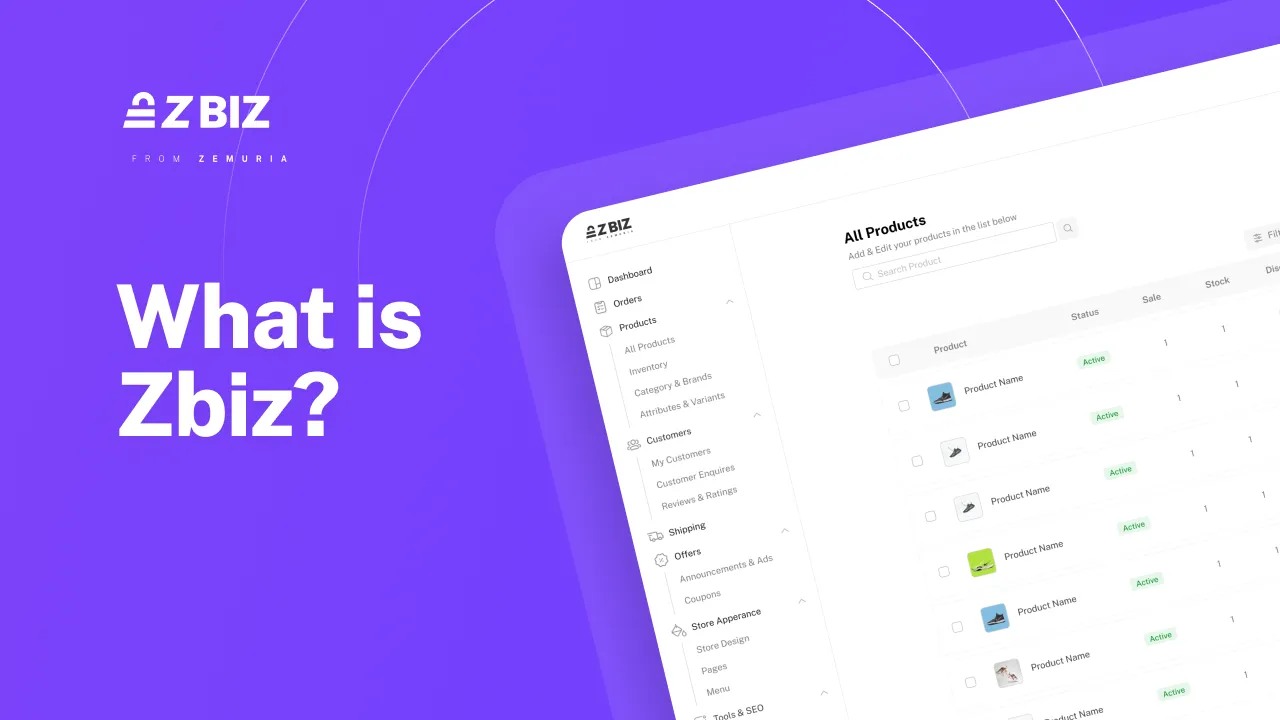

Many different sellers sell their products on their e-commerce websites. These sellers could be making their websites through platforms like Zbiz or Shopify. These sellers are called e-commerce sellers.

Some examples:

These e-commerce sellers may sell on one e-commerce portal like Amazon, or they may sell on multiple portals like Amazon, Flipkart, etc.

Additionally, these same sellers may also have their own physical shops or offices from where they sell their goods, in addition to selling online on the e-commerce portals.

So in simple terms, e-commerce sellers are any persons or companies that sell their goods or services through online shopping websites/apps like Amazon, Flipkart, etc, along with potentially having their offline shops as well.

The applicability of GST to e-commerce sellers varies depending on whether they supply goods or services. Let me break this down in simple terms.

However, there are some exceptions for service providers:

For those e-commerce sellers to whom GST applies:

In simple terms:

After understanding what GST is and what applies and what doesn’t, there’s a simple question that can pop up in your mind. What do I file now?

Let me break it down in simple terms using examples:

Due Dates:

TCS stands for Tax Collected at Source.

In the context of e-commerce, TCS applies to e-commerce operators/marketplaces like Amazon, Flipkart, Snapdeal, etc.

Specifically, these e-commerce operators are required to collect TCS at 1% on the value of supplies (goods or services) made by e-commerce sellers on their platform.

So when an e-commerce seller makes a sale on Amazon, for example, Amazon has to deduct 1% of the sale value as TCS before making the payment to the seller. This deducted 1% TCS is then paid by the e-commerce operator (Amazon) to the government.

For the e-commerce seller:

They receive 99% of their sale proceeds after 1% TCS deduction by the e-commerce operator. However, the seller can claim a credit for this 1% TCS paid on their behalf when filing GST returns. So in simple terms, TCS of 1% is a tax collected upfront by the e-commerce companies on sales made by sellers on their platform. The sellers can claim credit for this tax paid on their behalf later.

TCS applies only to the e-commerce operators and not directly to the e-commerce sellers. The sellers just have their sale proceeds deducted by 1% by the operators.

However, it is important to note that this does not apply when the e-commerce sellers have their own website.

Just like TCS is collected by e-commerce operators, they also have to deduct TDS from the payments made to e-commerce sellers.

The key points about TDS for e-commerce sellers:

So in simple words, the e-commerce companies deduct 1% of the sale amount as TDS before paying sellers, unless the sales were very low last year. Sellers can claim credit for this deducted TDS later.

Just like TCS, TDS is also a form of tax deducted upfront by e-commerce companies which sellers can claim credit for.

However, TDS is only applicable to those businesses providing services and not products.

In simple terms, we suggest that you file your periodic GST returns, and get your accounts audited if the turnover is high, and e-commerce platforms will deduct some tax upfront from your sales which you can claim credit for later.

For more GST Simplified Content, check us out at (GST-Simplified)

Check us out at GST Simplified, where all your GST troubles are taken care of, anything you need to know about GST is very well covered in this category in the simplest of forms. No more confusion, Say Yes to clarity!

Turn viewers into customers with video marketing. A beginner's guide to creating high-impact videos for your business

Explore everything about Zbiz, including its features, benefits, and plans. Also, learn how to customize Zbiz for your business’s needs

Confused by GST slabs & rates? This guide simplifies it for small businesses & e-commerce sellers. Run your business smoothly & stay tax-compliant!